You Can Outperform Warren Buffett

Over the last couple of months, I’ve laid out, what I think to be, a strong case as to why thinking long term and investing your money accordingly is important. Since starting this newsletter, I’ve been grateful to have had several people reach out to me to help them get started on their investment journey. This last week, I got to sit down with Tim and Jess (two subscribers and dear friends, thanks guys) and they brought up an important question: Should we be buying individual stocks? The answer, like almost all in the financial services space, is “it depends”.

What is an Index?

When I first set up my retirement account with money withdrawn from my Navy 401k, I really thought I was going to be the next Warren Buffett. Coming off the heels of reading arguably one of the best investing books of all time, “The Intelligent Investor”, I believed with some hard work and determination I could beat the market. When people say the market, they typically mean the SP500 index, which stands as a benchmark, or bare minimum to beat, for many active managers.

SP500 Index: An index (or list) of 500 generally “good” companies that is referred to as representative of the stock market as a whole. There are other indexes, this is by far the most popular. Because it’s not handled by a person, indexes are often called “passive” investing.

Active managers: People that get paid to manage portfolios by actively picking stocks

The reason active managers have to beat the SP500 index (or whatever their index benchmark may be) is that they charge a significant fee. Indexes generally have incredibly low fees, like less than 1/100 of a percent. As I pointed out in last week’s issue, the index generally goes up over a long enough time horizon and can be expected to return 7-10% per year. Active managers can charge anywhere from .5 to 2%. While this doesn’t sound high, those fees eat into your returns and over a long time period add up to a significant amount. So if you’re going to pay an active manager potentially 100x what it would cost for an index, they better be providing significantly better returns than the index.

Another note on indexes: Indexes are incredibly cheap because they’re run by computers, not people. You pay a small fee for a computer somewhere to handle the maintenance of the index.

Active VS Passive Performance

What’s interesting about index funds isn’t they have been around long, relatively speaking, but grow massively in popularity each year. The reason? They’re cheap AND they are outperforming! The photo below depicts the percentage of fund managers who have underperformed their benchmarks for the last ten years (this data is from 2019).

In this particular chart, fund managers and active managers are not synonymous; this is just here to depict that much of the institutional money doesn’t outperform over the long run. Active managers may run a “fund” but not all of them do. Funds are typically much larger pools of money and in this case separated by whether they hold small, medium, or large market capitalization companies.

Market Capitalization: Total value of a company, found by multiplying the stock price by the amount of shares outstanding

Let’s take that a step further because fund managers may have different benchmarks than what we’re speaking to. Because every company listed in the SP500 is considered large-cap (over 10 billion dollar market capitalization), it’s appropriate to compare the large-cap funds to the index. See for yourself - most don’t outperform over a long period of time. (This data is cited from a CNBC article which you can read HERE if you’d like). Over a long enough time horizon, most active management doesn’t outperform the index, and as a reminder - we’re long-term investors here at Scuttlebutt.

Why the underperformance?

Like I stated earlier, indexes are managed and balanced by a computer and require little to no upkeep, hence the low fees. Fees contribute to funds underperformance, but the reality is that fund and active managers don’t pick stocks as well. There is a committee of folks that get together a few times a year that determine what companies go into the SP500 and who gets removed based on a variety of arbitrary criteria. Then, the computers that manage these indexes that track it, see the change and institute it immediately. The combination of fees and stock selection from active management just can’t compete with the benefits of passive index investing.

Flows Into Passive

Over the last ten years, people are starting to recognize that passive investing may be the way to go. Not only can they outperform by buying an index but they can pay significantly fewer fees and also not have to worry about talking with their money manager every quarter because the index handles it for them!

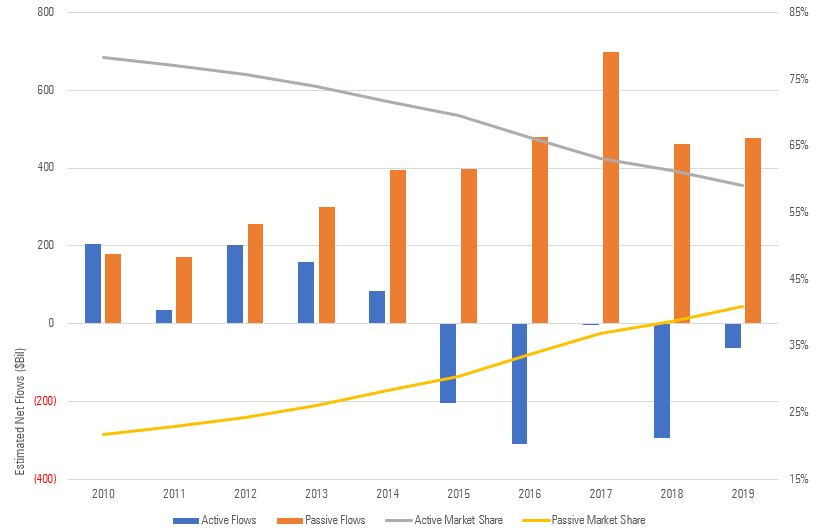

This chart has a lot going on and isn’t great - I apologize. What is most important is the blue and orange bars which depict “flows” or money invested into active management or passive management respectively over the last ten years. Notice how the orange is growing significantly larger? The two lines represent the total market share of active vs passive.

What’s also interesting to note about this graph is that the active inflows and outflows don’t necessarily equate to the passive inflows and outflows. This is likely driven by new money entering the system financial system. If it’s not money coming from active into passive, that means it’s coming from somewhere else. I think this is significant because it means that more people are taking part in the system by investing their money. This chart and a great article from Morningstar on active and passive flows can be found HERE.

What Does This Mean for ME?

I’m pulling the ship back around, don’t worry.

Personally, I love to spending time doing business analysis. All of my free time, the very little I have, is spent studying companies, understanding how they operate, reading financial documents, and listening to quarterly conference calls all information which I use to buy and sell companies in my personal account (Wow, that makes me sound like a really exciting person - I do have a life, I think). All of the time and work and I am not outperforming the index, in addition to the folks on Wall Street who do this for a living. I continue to do it however because it’s what I love to do. The hard truth of the matter is that you probably don’t love to do that or don’t have time. But that’s okay!

It clearly takes a lot to outperform the market as a whole. You may get lucky and do well for a year or maybe two. The market is at or near all-time highs right now with stocks ripping upwards every day and so that naturally leads to a lot of people who think they’re stock market wizards. I hold to the firm belief that anyone who says stock picking is easy hasn’t been doing it very long.

The good news for the person who doesn’t want to spend time studying companies all day long is the advent of the index fund. You don’t have to make your investing life complicated - just buy an index fund.

If you have an employer-sponsored 401k, go talk to your HR and ask where your money is going. Many 401k accounts have accounts that you yourself can dictate where your money is going. If you have an IRA set up (if you don’t, read this article on setting one up), set up biweekly or monthly contributions to your account and set it to buy however many dollars of an index. This automation makes it easy on you so you never have to think about it and over a long period of time will return 7-10% per year.

Another note on indexes: There are a TON of SP500 index funds available and they all do essentially the same thing. What you’re looking for is one with a low fee thats popular. I would recommend ticker (SPY) or ticker (FXAIX).

In conclusion, stock picking isn’t for most people. It just isn’t. It’s hard, takes a lot of time and effort, and even having those doesn’t guarantee you’ll do well. Make it easy on yourself and buy the index. I reference Warren Buffett quite a bit already but here’s one more for you. Early last year he gave some advice at his annual shareholder meeting: “For most people, the best thing to do is to own the SP500 index fund”. He’s got his money where his mouth is on this because he has instructed the trustee in charge of his estate to place 90% of the assets into an index for his widow. The SP500, ironically, has actually outperformed the stock of Berkshire Hathaway in recent years. Maybe he knows something we don’t.

One last note. This topic is an important one and came as an actual question from real people. The beauty of this space is that if you are confused about something, I guarantee someone else has the same concern. It gives me so much joy to answer questions and get people going on their path SO - If you have a particular question, don’t be selfish and ask it! I love diving into these topics and trying to make them as easy to understand as possible. You’re welcome to comment on this post or send me an email directly!

Talk next week

~Brock

If you are a first-time reader, welcome to the Scuttlebutt! I hope you liked what you read - if you did and want this in your inbox weekly, hit subscribe here!