If Saving Money is Wrong, I Don't Want to be Right

Why savings rate is more important than investment returns

Hello everyone! Hope you all are getting your week started off strong.

This last week, I was listening to a discussion about the importance of how saving is compared to investing returns. When people talk about building their nest egg for retirement, much of the conversation is around what percent return they’ve gotten, not about how their savings over time. Curious about the two, I decided to put together a mock example that is fairly similar to my own personal situation, to see how important the savings is as opposed to pure returns. Let’s dive in.

Case Study

Assumptions:

Starting age: 30 years old

Beginning Savings Balance: $0

Starting Salary: $50,000

Annual Salary Increase: 3%

Annual Investment Return: 7%

I want to portray someone truly just getting their adult life going, hence no prior savings and an average yearly salary. I also included an annual salary increase even though pay raises may come less frequently - I chose 3% to be conservative in hopes that the reality might reflect better results. The same for an annual 7% return.

To stick with a conservative theme, I want to start with a small savings number. People spout “Oh just save 20% of your income for retirement every year” - the reality is that we’re real people and it just isn’t that easy. I started small assuming you could save 5% of your annual income which works out to about $208 a month ($2500/year) on a $50k salary. Here’s what the first few years played out look like -

This assumes a savings deposit at the end of the year and your 7% return entered at the end of the year. The column ‘Investing Return’ (Ending Balance - 5% Saved) is here to show how the returns start small but grow larger over time.

Couple of things to point out:

Committing to a percentage of savings rather than a dollar amount allows your savings to scale with your salary over time. If you can save 5% at a $50k salary, you can obviously save 5% at a $51.5k salary.

Notice how small the investment returns are in comparison to savings numbers at the beginning? It stays this way for quite a long time.

Let’s fast forward to age 65….

Boom now you’re retired.

Here’s what the last few years look like.

Notice The investment returns are now dwarfing the savings inputs. Ahhh the beauties of compound interest.

End Result

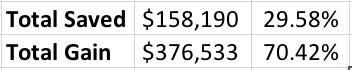

Now let’s compare totals. After saving 5% of our income at 7% returns for 35 years, we have a grand total savings of $534,722. Not too shabby. Of that number, this is the final breakdown of our input (total saved) and the returns on investment (total gain).

~ 70% of our end total dollar amount is from investment gains. But how could this be starting off such a small base? To compare the investment gain contribution at different points in time, I went back and looked at this breakdown at age 40, 50, and 60.

This shows us how long it takes for investment gains to actually outpace the raw dollars contributed. After 10 years of investing, not even a 1/3 of your total comes from investment gains. Furthermore, your investment returns don’t even match your savings contributions until 20 years of saving. 20 years!

So What?

What this example shows is the importance of your savings rate, especially at the beginning. Building a habit in your early life of committing a fixed percentage of your income to savings builds the foundation for your future life. A few weeks back I wrote a piece on why indexing outperforms - some of those years you will have a negative return. The habit of saving money every two weeks means more to your financial life than investment returns ever will. Start putting money away and the returns will figure themselves out.

In the vein of not being able to control returns, power over your chosen savings rate is within your control. The beauty is that dictating a savings rate is not any more difficult than a dollar amount and can be automated. Small increases in your savings rate can accelerate those numbers we saw earlier.

To highlight how small changes can make a big difference, here are some final total numbers based on savings rate increments.

A single percentage increase in your savings rate over the course of 35 years results in a difference of over $100,000 in retirement. At age 30, this is the difference between saving $2500 and $3000 per year.

Takeaways

Your savings rate is far more important than your investing returns

Pick a savings rate rather than a dollar figure so your savings can scale with your income growing over time

Automate if you can - most employers offer automatic withdrawals based on these percentages. Make it easy on yourself and use these tools!

As a reminder, I’m on a mission to raise $2000 for two charities - the Wounded Warrior Project and the Jump$tart Coalition. WWP helps physically and mentally wounded veterans get the help they need and Jump$tart helps get financial literacy taught in schools. To bring awareness to these two, I’m participating in the Goggins Challenge this upcoming weekend, March 5-7, which involves running 4 miles every 4 hours for 48 hours. If you feel compelled to donate, I have a GoFundMe set up and you can follow the link below. If not, that’s okay! Sharing the post is just as powerful - I’d like to get as many eyes on both charities as possible. Click here!

Talk next week

~Brock

If you’re a first-time reader, welcome to the Scuttlebutt! If you liked what you read and want to join the dozens of other masters of personal finance, drop your email:

You also have to take into effect the cost of living increase. The price of everything is growing each day while salaries are at a stale mate. I still trust a Mason jar full of money over a Bank