What Goes In Must Come Out

Did you know the average person makes around 35,000 conscious decisions every day? Your mind is on a constant teeter-totter of decision making, weighing the outcomes on every move you make from the socks you chose to wear to what time you go to bed. It’s no wonder we make bad decisions sometimes; that many choices to make every day and we are bound to mess up on a few of them. So how do we focus our time on the right decisions and make sure we get the best outcomes?

Comparing Outcomes

This is a timeless question and one that is answered in economics by the idea of opportunity cost.

Opportunity cost is the loss(es) or benefit(s) from another outcome that you could have chosen.

My choice to eat a burger for lunch implies that I can’t have a salad. My inability to have a salad is an opportunity cost. The potential health benefits of having the salad and the hunger I would feel from not getting full from the salad are also both opportunity costs. The word cost here doesn’t imply it being positive or negative, just the foregone outcome of another decision.

While the phrase “opportunity cost” may or may not be new to you, the idea of weighing outcomes surely isn’t. We learn reasoning and decision making at a young age, making the connection that if we do one thing, this other thing comes as a result. If we don’t do our homework, we get scolded. If we finish our dinner, we get ice cream. Life, early on, becomes a game of what carrot is at the end of the stick for me.

No Such Thing as Guaranteed Results

As we get older, the carrot on the end of the stick changes. We even have experiences where we were promised a certain carrot but due to some unforeseen circumstance, it wasn’t there when we did everything required to reach it. With the more complex things in life, there may an element of luck or chance that plays into how things turn out. We all have one of these stories.

This chance or luck thing seems to crop up more and more over time. If I had a nickel for every time I heard a business owner or successful person say “I just got lucky” or “I was in the right place at the right time”. You can’t rely on or count on these intangible things! But there is something you can rely on, something that doesn’t change over time. Your inputs.

What Goes In, Must Come Out

It’s counter-narrative, but I believe the larger opportunity cost to consider when making decisions is actually the input, not the outcome. Money, energy, and most importantly, TIME, are all inputs to decisions today that have less value tomorrow. The time and energy you have to accomplish something today won’t be available tomorrow. They’re finite assets. A dollar in your pocket is worth less tomorrow than it is today based on the time value of money.

Time value of money states that a sum of money today is more valuable than the same sum at any point in the future because of earnings potential. That money could be a savings account earning interest, invested in a business, or loaned out.

The point is that you should take extreme care when allocating your limited assets (inputs) because those are the things you can actually control. I’m not sure how to quantify the luck or chance element, but outcomes have a way of working themselves out when you’re doing the right things. An athlete headed to a competition who hasn’t practiced has a much lower chance of success than the athlete who has practiced every day for the last year. They’re both going for the same outcome, but one is much more likely to succeed. It’s all about reps.

Application

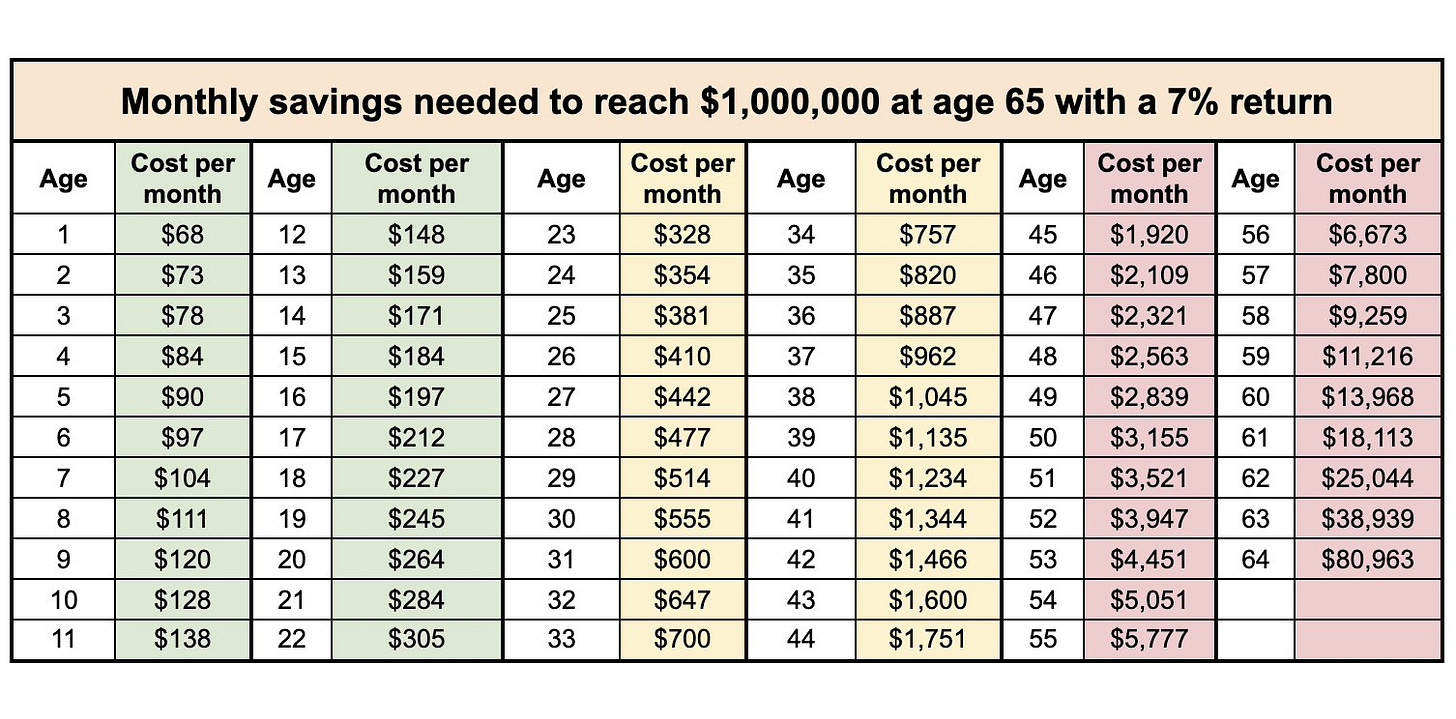

I came across a chart this week that shows the opportunity cost of your inputs extremely well. While everyone has different goals, a million dollars is a popular number to try and achieve by retirement. This chart shows how much money is needed to be saved/invested PER MONTH at a 7% return if you want to retire with a million by 65.

I have a love-hate relationship with charts like these. It’s cool to see, but it sure makes you think hard. Each month, the cost of that million-dollar retirement goes up by a larger and larger amount, getting more difficult every year that passes by. I’m age 27 - the opportunity cost of savings from this year to next is $35, probably one dinner out to eat.

What’s the opportunity cost of your inputs today? Draw the connection between what you do today and what you’ll wish you had in the future. Your future self will thank you.

All in all, what we do every day is far more important than what could happen in the future. The outcome of your decision making will take care of itself when your time, money, and energy are aligned with your long term goals. Your inputs are limited and what you have at your disposal today - don’t let them go to waste! A question I try to ask myself every day is “What is something I could do today that I’ll thank myself for in 5, 10, or 20 years?”.

Get out today and put in the reps.

A closing and somewhat unrelated message. I’ve decided I’m going to participate in the Goggins Challenge to raise money for charity. The challenge takes place March 5-7 and involves running 4 miles every 4 hours for 48 hours. I’m raising money for two charities near and dear to me - the Wounded Warrior Project and the Jump$tart Coalition. WWP helps physically and mentally wounded veterans get the help they need and Jump$tart helps get financial literacy taught in schools. My goal is to raise $2000 and split it between the two. If you feel compelled to donate, I have a GoFundMe set up and you can follow the link below. If not, that’s okay! Sharing the post is just as powerful - I’d like to get as many eyes on both charities as possible.

Talk next week

~Brock

And you think you have a love/hate relationship with that chart........