Pay Unto Caesar

Understanding Taxes And How To Pay Less

If you’re not smart AND rich, you should be reading Scuttlebutt weekly. Drop your email below and we’ll get you there.

Can you share some feedback with me? I’m continuously evaluating the best way to deliver this content and one click helps me out a ton.

How would you prefer to consume personal finance content?

Ebook Weekly Class One on one coaching Podcast Weekly newsletter is fine

What do you think of when you heard the word “taxes”? If you’re a middle-class American, you likely cringe a bit. The idea of giving your money away to the government doesn’t feel good. Articles like ProPublica’s recent piece on how wealthy individuals pay zero dollars in taxes further make it feel like we aren’t getting our slice of the pie. The bad news is that you aren’t getting your slice; the good news is that it can be done.

High level, taxes are what enable a country to function. You and the rest of the citizens of your country contribute a portion of your income in order to have the infrastructure available to you. You need roads to drive on, power to your home, public services like transportation, etc.

Things considered public services change from country to country and thus taxes are different. Anyone who says Canada is better than the US because they have “free” healthcare has never looked at tax rates paid by individuals there. This isn’t to say the US healthcare system is in great shape, but our capitalist roots tend to push money into the hands of its people, not the governments, on the belief that it will contribute to the most economic growth. So far, that’s proved true.

The following chart shows a comparison of tax revenue as a percent of total GDP or total monetary value of finished goods and services. The US ranks near the bottom when it comes to taxes paid. For context, the US has roughly over 7x the GDP of France.

Your Contribution

So where do you come in? The following chart shows the single and married couples marginal tax rates in 2020.

Notice the “But not over” column? The reason for this is because once you make over $9,875, you actually are in multiple tax brackets and pay tax corresponding to where you fall in the brackets.

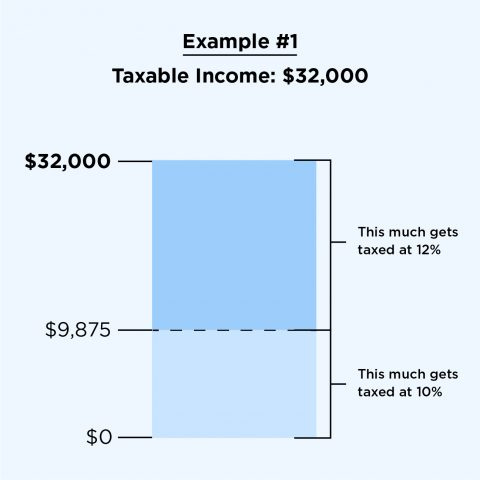

Let’s say for example you made $32,000 in taxable income in 2020. The first $9,875 is taxed at 10%, and the remainder (32,000-9,875) $22,125 is taxed at 12%.

This process continues as you progress up the tax scale.

Lowering Your Tax Bill

There are two ways to lower your tax bill - deductions and credits. Deductions lower the amount of taxable income you have and credits are a raw dollar amount given back to you. Credits will always go further when it comes to your final bill, but deductions shouldn’t be forgotten about either.

Credits

There are hundreds of things you can receive tax credits for. These are the questions that you get pelted with when sitting down to go through TurboTax every year. It’s tempting to click through them but there are so many things you can get money back for.

A few big tax credits you can get:

Adoption - Up to $3,000 (3600 if under 6) for adopting a child

American Opportunity Credit - Up to $2500 in college tuitition, books, anything non living for undergraduate students

Child credit - Congratulations, just for bringing a child into the world you get $3000

Savers credit - Up to $1000 for contributing to a 401k or roth/traditional IRA

Don’t blow through the questions. Most tax software (Turbotax, HRB, etc) have to ask all the questions, you just need to input the information. It’s also worthwhile to dip into the “other” categories when filing to see anything else you may qualify for.

Deductions

When you file, you’re given the option of taking the ‘standard deduction’ or ‘itemizing’. Both options are deducting the total amount of money you made and thus have to pay tax on. The difference is whether you want to take the basic $12,400 deduction they offer everyone or individually list out everything you should receive a deduction for.

The reason to itemize is that you have deductions that are greater than the standard deduction. In other words, you need to come up with more than the standard deduction amount to make it worthwhile to itemize.

A few big items you can deduct when you itemize:

Medical expenses - Any medical expenses nonreimbursed or covered by your employer over 7.5% of your adjusted gross income are deductible. If you had surgery or another unexpected medical issue, this would come in handy.

Mortgage interest - Interest payed on your primary home mortgage is deductible.

Property taxes - Up to $10,000 in property taxes paid

The important thing, as with credits, is keeping diligent records throughout each year. You’ll want of copy of that mortgage interest if the IRS comes a knockin.

Another part of deductions is ensuring you use retirement and savings vehicles to lower your income as much as possible.

Contributions to your 401k, up to $19,500 every year, on a pretax basis, lower your taxable income from the year. While taxes on this do come full circle, a dollar today is worth more than a dollar tomorrow. This also applies to contributing to a Traditional IRA (up to $6000 per year). Because Roth IRAs are post-tax, those contributions don’t lower-income but do make you eligible for the saver’s credit I mentioned earlier.

Two other big items to reduce your income, 529’s and HSAs. Most states allow the tax benefit for 529 plans which are advantaged education funds for your children - who don’t want to see them get that degree right? Think of the children.

HSAs are health savings accounts that allow yearly contributions to pay for medical expenses. They enjoy the benefit of tax-free contributions, tax-free withdrawals if qualified medical expenses, and reduce taxable income. These are often offered through your employer and occasionally are eligible for a match, if your employer loves you.

You can read more about those tax-eligible items here.

Business Owners

If you want to roll with the wealthy 1% of the country, the way to do that is to start a business, plain and simple. Business owners have access to a healthy list of credits and deductions that often separate the concept of “making money” and paying taxes on that.

In 2018, Amazon paid no federal taxes and received a $129 million dollar tax rebate on $11 billion in profits. How? Tax-loss carryforwards, R&D investments, and stock-based compensation.

Former President Donald Trump famously has paid a mere $750 in taxes on millions in profits stemming from his known love of depreciation. Depreciation is the concept of lowering the value of the real estate over the course of its expected life. I wrote a bit on why depreciation is such an important factor in Your Home Is Not An Investment.

Want to reap the benefits businesses have? Go start one.

Thanks for reading, talk next week.

~Brock