Welcome to our 2 new readers of the Scuttlebutt! If you aren’t subscribed and are looking for actionable finance and business knowledge weekly, join us! If you find something valuable here today, share it with someone.

Good morning and welcome to a new week!

Today I want to cover a bit about inflation, something that seems to be the talk of business news recently. You know how you used to be able to fill up your tires for free and now it’s $1.5 for 2 minutes of air. Inflation! Who knew you also got bad puns with your subscription to this newsletter.

Full Of Hot Air

If you don’t know much about inflation, let’s talk something you do know: prices. Notice recently that grocery bill is a little higher than normal? We know the big ticket items have increased recently, think housing, medical costs, and don’t even get me started on education. Each of these things is experiencing some form of inflation.

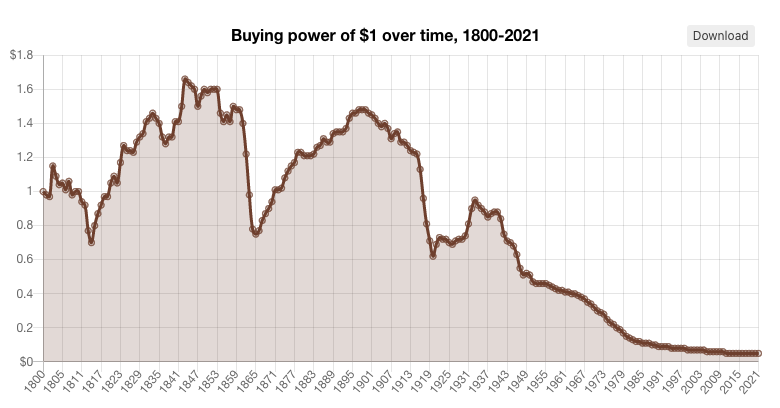

The textbook definition of inflation is a general increase in prices and fall in the purchasing value of money. Think of purchasing value as the unusually large discrepancy between what it costs you to go to the movies compared to your grandparents when they were kids.

This chart shows the buying power of $1 over the last 200 years. From this data, something that cost one dollar in 1913 would cost $27.19 today.

Is This…Normal?

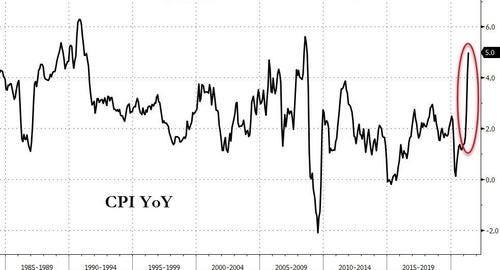

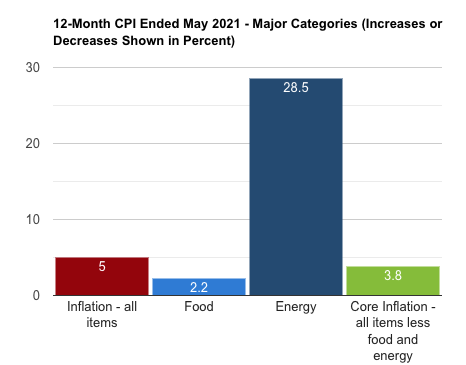

A government agency called the Bureau of Labor Statistics is tasked, among many other things, to release regular reports on something called the CPI, or consumer price index. The CPI attempts to measure what it costs to live in the US by looking at prices of food, housing, medical care, education - you name it. This index is important because it’s used as a measure of inflation.

If for some sick reason you’re interested in reading the report, you can check out that link here.

Last week, the Bureau of Labor Statistics released a report stating the index, over the last twelve months, increased 5% for all items. You’re paying on overage 5% for the same things you bought last year. Another way of saying, your dollar doesn’t buy as much.

Here’s a chart showing the CPI index since the 80’s.

Why Us and Why Now

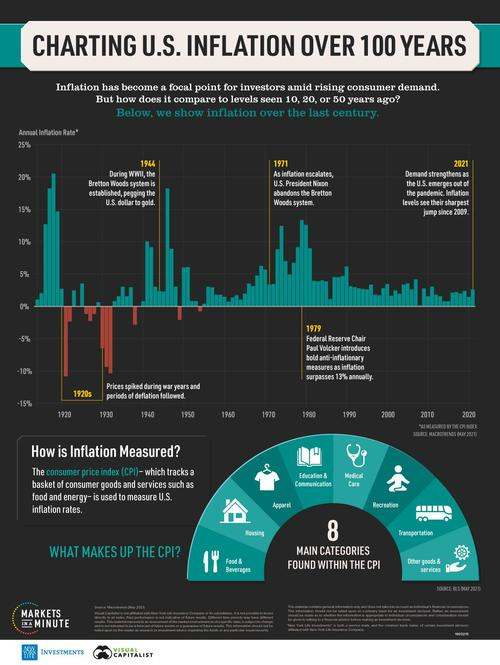

Any increase in costs sounds bad we are supposed to have some inflation. Why? Well because we’re a growing country! In the movie theatre ticket example with your grandparents - there’s a reason it costs more and it’s because the experience is much different. Odds are you rode in a nicer car to the theatre, had ten times the amount of movie options available, and viewed a bigger screen in better resolution. Of course that should cost more.

The long term target for inflation has been 2% and that’s because that is close to the pace at which the US grows GDP (gross domestic product - the total value of goods and services produced in one year). To continue to output more, we have to have some amount of inflation.

This begs the question, why are we seeing such high inflation now?

Let’s think for a minute about all the inputs to what we’ve covered. This all revolves around growing as a country to produce more. In that we need raw materials, we need labor, and we need people willing to make investments in growth.

Apply those in the context of COVID sweeping the country and what do you get? Problems.

WE’RE CLOSED

At the onset of COVID in early 2020, almost every business was closing its doors in anticipation of greatly reduced demand and uncertainty. This disruption stopped goods and services from being produced, interrupted supply chains, and put almost the entire ‘supply’ side on hold. What no one was expecting how the ‘demand’ side responded.

The last twelve months has been an explosion of demand on almost every front. People are buying houses like crazy, car sales through the roof - money is being spent. The problem is that the producers for those goods shut down and are attempting to get back up to speed. This has led to commodity shortages and skyrocketing prices in lumber, energy, and semiconductors. The collision of large demand and short supply is a mismatch called and inflationary gap.

Sending half the country onto unemployment has put a further crunch on ramping production back up. Many entry level jobs have been desperately hurting to get people back working which only delays the recovery.

Having just gone through the home buying process, we’ve experienced how much everything is backed up. It’s 8-12 weeks to get almost everything; refridgerators, applicances, sofas, EVERYTHING.

Money Money Money

The last factor influencing the recent run in inflation is money supply. In times of need, and a lot in not need, the government has been known to “print” money, or put new money into circulation that wasn’t there before.

Imagine you live in a town of 10 people and every person has one coin to buy and sell things. All of the sudden, with the same 10 people, there’s now 11 coins. Your coin is now worth less because there’s more of it. If the town grew to 11 people, the value would stay the same. In this case however, an increase in the money supply that doesn’t match economic growth leads to a devaluing of the currency.

Last year the government increased the money supply in the US over 26%, the largest yearly increase since 1943. A bulk of that money went into stimulating the economy to start back up again, its just taking time for that to happen.

We’ve seen circumstances similar to this in war times. The chart below shows inflation in the US over the last hundred years. World War 1 and 2 were both times of high inflation because of similar causes we have now. The government printing money to fund war efforts. Disruption to business by altering labor force and supply demand mismatches due to demographic changes.

So What?

So what do we do with this information?

Much of what you see on the news would suggest that action is required on your part. Many people remember the 70’s where the US experienced near 20% inflation and believe we are heading for that point again. I disagree.

The best hedge against inflation is owning assets. To me, this means either owning real estate or by investing in the stock market. Some may offer the argument for owning gold; personally I’m not convinced its the best option.

Here’s an example of returns on different asset classes compared to inflation during a few select time periods. Gold, in these two examples, has not held up well.

You’ll see from the graph that REITs performed very well, being a collection of real estate. I wrote a piece on investing in real estate which you can check out here. Owning a house can be a great hedge against inflation. Locking in a low interest rate right now allows you commit to paying a fixed dollar amount even though your future dollars paid will be worth less. That’s good for you!

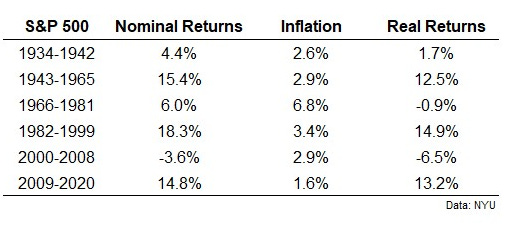

The stock market is also a great place to park your money. Investing in money generating businesses protects your dollars while offering reasonable return. The chart below shows the nominal and real returns (real = nominal - inflation) of the SP500 during a few select time periods.

It’s not as doom and gloom as many people might lead you to believe. Inflation, however, is an important concept to understand and a great reminder of how important it is to be putting your money to work.

Talk next week

~Brock