Growing A New Generation

Investing In Marijuana

Welcome to our 7 new readers of the Scuttlebutt! If you aren’t subscribed and are looking for actionable finance and business knowledge weekly, join us!

Happy Monday! It feels good to be back.

This week I’m doing a company profile on a company I’ve taken a keen interest in. Personally, when I make investments in individual companies, I believe it's important to understand as much about a company as possible. The more I know, the less likely I am to be scared out of a stock if the price swings wildly and the better I sleep at night. In an actively managed account, the key to long-term holding success is knowing what you own.

I’ll start with an industry overview and then dive into a specific company that I believe is positioned to grow and excel over the coming years. At the company level, we’ll explore the business model, how the business is performing, and what we can expect from it in the future, all through an investment lens.

Today, we’re talking cannabis.

A Quick History Lesson

Cannabis shouldn’t need much of an introduction. The psychoactive drug used for both medicinal and recreational purposes has a long history of use throughout the world. There are many conflicting views on the “gateway drug” that is evidenced by the long legal history cannabis has undergone in the US. While the last ten years has sparked a wave of recreational legalization, this story begins much earlier.

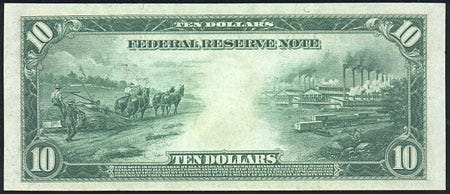

The story of cannabis, in particular hemp (a distinct strain of cannabis Sativa with low concentrations of the psychoactive component THC; used industrially making paper, textiles, plastic, etc), begins actually with the birth of the United States. In the mid-1600s, colonists of Jamestown were growing hemp to support England, shortly after colonization. The growth of hemp aided America’s early growth. Fun fact, one of the early 10 dollar bills displayed a hemp harvest scene on the back!

It wasn’t until the mid-1800s that cannabis began being used medicinally in the form of extracts available at pharmacies. As popularity grew, so did the scrutiny. In 1906 the Pure Food and Drug Act was passed which required the proper labeling of medicines. This law was the beginnings of prescription drugs as well as the conversation around habit-forming drugs. In an effort to prevent habitual use, cannabis was deemed a habit-forming drug which prompted state-wide banning throughout the 1920s.

Spurred by the wave of state sponsored cannabis bans, federal law made possession or transfer of marijuana illegal in the US with the Marihuana (not a typo) Tax Act of 1937. (It’s important to note here the time difference with which the states and federal government act on this issue. This will come up again later.) This did not apply to medical or industrial use, but increased scrutiny made any use difficult. This act ended up being deemed unconstitutional, violating 5th amendment rights, in Leary v United States which brought about the Controlled Substances Act in 1970. This deemed marijuana a Schedule I drug, prohibiting all uses including medicinal.

What’s interesting about the Controlled Substances Act is that it expanded the restrictions on marijuana but simultaneously lowered the sentencing requirements. Mandatory minimum sentences were thrown out as well as reducing possession of marijuana from a felony to a misdemeanor. This bill with seemingly conflicting goals may have been the green light to the era of the late 60s and 70s where use became more popular.

Modern Use

State decriminalization began to reverse in the 70s beginning with Oregon in 1973 but it would be another twenty years before more pro-cannabis legislation was passed. The next milestone for legalization came when California became the first state to pass medical marijuana in 1996 followed by recreational use by Washington and Colorado in 2012.

As I mentioned earlier, we are seeing the same disconnect between states and the federal government when it comes to passing marijuana legislation only now in reverse. It’s incredible to see the swiftness of adoption over the last ten years, especially the last few. In the last six months, major states adopted recreational programs including Arizona, New Jersey, and New York. Below is a map of where each state is in the process.

Medical Use

If the growing trend of recreational legalization is any indication of the future, we will see federal legalization may be sooner rather than later. It’s difficult to say what the desire for recreational use will look like, but what’s more sure is the growing adoption in the medical space. While most states have long adopted medicinal use, I believe the benefits found in scientific studies are just beginning.

The use of CBD (cannabidol, an element of cannabis plants that makes up for 40% of its extract) is expanding and beginning to be accepted medically to treat chronic pain, PTSD, depression, and many others. Treatment for conditions traditionally relied heavily on opioids and other less savory treatments that fuel addiction and pump pharmaceuticals onto the streets of our country.

The Center for Medicinal Cannabis Research at UC San Diego conducted a study last year that compared prescription drug use over six months while integrating cannabis into treatment. The results are staggering.

While not quite as scientific, I’ve been able to see the effects of CBD in people with conditions such as these over the last few years. My mother, who worked at a medical growing operation, has since stopped and begun working as an individual pain consultant, creating salves, ointments, and lotions infused with CBD to help treat these conditions. The reviews from her customers are powerful - stories of weaning off steroids and painkillers for a product that is not only cheaper but actually makes them feel better than the alternative. The space and application of CBD is in the very early innings and I’m eager to see the future of CBD in modern medicine but her business as well. If you’re interested in speaking with her I’d be happy to put you in touch!

Investing In Green

The benefits not only of growing retail and medical cannabis markets are sure to make good investments then, right? Maybe. Lots of money has been flowing into publicly-traded marijuana companies in hopes to ride the wave of pending legalization. To give some context on size, a Forbes article cited US cannabis sales at 17.5 billion dollars in 2020. They went on to further say we could expend 45 billion in sales by 2026, a 20.7% compound annual growth rate. There is certainly money to be made.

Most companies making headlines in business news are growers and distributors, companies that cultivate marijuana and facilitate the sale of their products in a variety of formats through retail stores. Popular companies include Canopy Growth, Aphria, and Cronos. The problem I see with owning companies like these is the coming competition over price.

As demand continues to rise, more and more companies will pop up to feed that demand. More options are generally better but force the consumer to decide where to shop. Given many growers carry the same popular strains of marijuana, there won’t be a way to distinguish themselves other than price. What this means is that the growers with the largest scale will win the business. The ability to produce more drives down fixed costs that will bully out small producers. This is the case for most commodity businesses like oil, lumber, or corn. While it may be some time still, marijuana will be a commodity in the future.

Because of the commodity-esque future I see in cannabis, I don’t believe growers will make compelling investments in the long term. There likely will be a few big winners but it is difficult to see how they will differentiate themselves to succeed long term. What I’m more sure of as an investment are the literal picks and shovels of the marijuana industry. Enter Grow Generation.

Grow Generation

One thing not widely known about the industry is the growing process. It’s not as simple as throwing a plant in the ground and hope for a good crop. Proper growing has hundreds of variables that all impact the yield of each plant. These variables range from soil type, temperature, lighting, lighting hours, nutrients - all of which require specific equipment and supplies. Grow Generation (GRWG) fills that need.

Grow Generation operates the largest chain of hydroponic garden centers in North America. Founded in 2014, GrowGen operates retail stores and fulfillment of gardening supplies that focus on hydroponics which is the use of growing things in sand, gravel, or liquid without soil. This is the predominant way cannabis is farmed because it allows for shorter life cycles and better control of what enters the plants. Hydroponics is also preferred due to the shortage of farmland and the protection offered from extreme weather.

Inside GrowGen retail stores, you’ll find a variety of products. Imagine the gardening center of a Home Depot or Lowes but with a focus on cannabis. You’ll find everything from lighting and timing systems, temperature and humidity control devices, watering mechanisms, and different types of nutrients.

The Market

The retail stores serve individual growers (mom and pop growing at home) and commercial (think major growers listed earlier), both of whose opportunity is extremely large. While many people may enjoy the convenience of buying cannabis products from a store, many people will opt to take advantage of growing their own plants at home. Many states allowing recreational use are allowing individuals to grow up to four plants at home.

While individual growers do present an opportunity for GrowGen, I believe the true opportunity is in the commercial. With hydroponics, efficient commercial growers will have multiple plant cycles in a year which creates a recurring need for consumable products like nutrients. This will lead to repeat orders and larger average ticket sizes. Last year commercial sales made up 25% of GrowGen’s revenue, up from 21% in 2019. According to its financial filings, GrowGen believes there to be over 15,000 cannabis cultivation licenses active and projects hydroponic equipment sales to surpass 16 billion by 2025.

Go To Market

GrowGen currently operates 53 retail stores across 12 states as well as operating an e-commerce website whose orders are filled from its fulfillment centers. The retail strategy has hinged closely around established cannabis markets as well as ones GrowGen believes will be large drivers of business going forward. Twenty of the retail stores are located in California, ten in Colorado, six in Michigan, and so forth.

There are currently two fulfillment centers operating; a 60K sq. ft. facility in Sacramento California and a 40K sq. ft. facility in Tulsa Oklahoma. In March of this year, GrowGen announced four more fulfillment centers opening which will not only produce greater flexibility with online orders but move the company closer to new developing markets. The following are the new centers coming:

Los Angeles, CA: 52K sq. ft.

Rancho Dominguez, CA: 70K sq. ft.

Phoenix, AZ: 25K sq. ft.

Medley, FL: 58K sq. ft.

The expansion into Arizona and Florida are strong moves into what will likely be massive markets. Arizona legalized recreational marijuana earlier this year. Florida has been facing challenges to push recreational but I think will come sooner rather than later.

Business Model

What’s unique about GrowGen’s business model is that it has taken the fast track for growth. Rather than build out business store by store, GrowGen has used its funds to buy existing gardening locations, rebrand the businesses, and bring them all under one collective umbrella. This growth strategy hinges around successful purchase and integration of new locations. I’ll talk more about this later in risks.

The rate at which the company has made acquisitions is quite a feat. In 2021 alone, GrowGen has completed 9 acquisitions, bringing 15 new locations under the collective name. Once purchased, GrowGen is able to plug those locations into its fulfillment network as well as fill those locations with its own private label products, another element of the business strategy.

In the last six months, GrowGen has acquired two private label brands, Canopy Crop Magenement and Charcoir, which both sell nutrients and equipment. With ownership of these brands, GrowGen is able to push those brands in retail stores and online. Being wholly-owned, the gross margin of these products is much larger than that of others sold.

While it’s a big buzzword to have an e-commerce strategy, GrowGen is in the early stages of e-commerce penetration. It offers direct shipping or buy online and pick up in-store. In 2020, only 5% of revenue came from online sales. Due to the nature of the products (ie heavy lighting, heavy bags, etc), I think this is to be expected. Logistics and last-mile delivery, especially for odd items like these, is a challenge. I’m not expecting e-commerce to be a substantial part of revenue going forward.

The last part of the business model I’m watching is an acquisition GrowGen made earlier this year of a business-to-business platform called Agron.io. Agron is an enterprise resource planning technology that allows commercial growers to make large purchases, estimate logistic costs, aid with state regulations, and manage transportation and hazmat fees. Agron will contribute 20 million dollars of revenue to GrowGen this year and will benefit from having a supplier of the equipment its already selling.

Growing Like A…Weed

GrowGen has been growing like a weed, forgive the pun. Last year the company did 193 million in revenue, up 142% from 2019 at a 26% gross margin. The company is currently expecting to do between 450 and 470 million in revenue for 2021. more acquisitions are made this number will continue to rise. This forward sales implies the company currently trades for 5x sales (current 2.2 billion dollar market cap, 450mm sales).

On the balance sheet, at the end of last quarter, had 133 million in cash and receivables, 45 million in current liabilities, and no long-term debt.

Risks

I’d be remiss to not talk about risks with a small growth company like GrowGen. I think the biggest risk the company faces is execution risk. Right now, the company is funding its acquisitions of new stores by selling shares. The amount of shares outstanding has risen by over 50% in the last year, diluting current shareholders in order to grow more. The revenue growth the company has been putting up surely wouldn’t have been possible without the cash to execute that. This strategy can work until it doesn’t anymore.

As a shareholder, I don’t love the dilution but I do believe that time is of the essence. There isn’t one dominant player in the hydroponic equipment space, yet, and I believe GrowGen has a chance to be that player. The industry is incredibly fragmented and would benefit from consolidation. The company cites that there are over 1000 retail hydroponic stores, not even counting online stores. Personally, I’d rather see the company establish a dominant foothold in the market while we continue to push forward on legalization.

This land and expand strategy is seen clearly in how management is incentives. Top executives earn a base salary with a bonus of .5% multiplied by the amount of new revenue in the last year. For a small growth company, I think this is okay, but I don’t love it. I’d like to continue to see triple-digit revenue growth numbers if they continue to sell shares at the rate they have been.

As far as operations go, I believe the company is performing well. For the 22 stores that were all open in the prior year, GrowGen posted 51% same-store sales growth which is fantastic for a retail store. A number to watch as newer stores grow into maturity. As far as customers, no customer accounted for more than 5% of the company’s sales so concentration risk isn’t an issue.

The company recently had some corporate turnover; the old CFO departed which raises some eyebrows. The replacement, Jeffrey Lasher, was brought in from Crocs which I think is a promising move. I’ll be closely watching his addition to the team.

Takeaway

Overall, I’m cautious but extremely optimistic with Grow Generation. I think there are some areas to watch when it comes to growth and share issuance, but it’s clear to me the company is well positioned to take advantage of the wave of green we are seeing sweep the US. Widespread legalization is coming and I believe they are the right company to supply the tools to make it happen.

In an effort to be transparent, I do own Grow Generation (GRWG) and it is my largest position. I’ve held it for some time and plan to continue to hold it as long as the business continues to execute.

This is not a solicitation to buy or sell any security listed.

As always, would love comments, questions, or constructive criticism! Drop me an email by replying to this or post a comment below. Talk next week.

~Brock