Getting Your Financial House in Order

Do you ever have a long list of chores to get done but you can’t start because your living or workspace isn’t clean? It’s amazing how spending an hour organizing and getting everything into its rightful place prepares you to work better. Before I even start my coursework each day, I spend 15-20 minutes straightening my room because I literally can’t think straight otherwise (thank you to my mother for reading this and passing on this wonderful…curse/trait). Whether you’re blessed with this ailment or not, your financial life is the exact same way. How can you expect to plan for your future if you have no idea where you are now?

I think this is the reason people avoid thinking and talking about their finances - they don’t know! If that’s the case with you, I don’t blame you, but I will politely tell you it’s a problem. While a blessing and a curse, most financials are handled online which requires passwords and we all know how those go. This week, we’re going to solve this problem and put technology to work for us and, I hate to break it to you, but you have a homework assignment.

Today I’m going to highlight the best tool on the market to get your financial house in order; Mint. Mint is a personal financial management tool, available as an app download or on your computer. What it does is aggregate all of your financial data have under one roof. You’re able to connect your checking/savings accounts, credit cards, investments, retirement accounts, car loans, EVERYTHING. While that sounds like a daunting task, I can assure you it’s not half as bad as it sounds. We’ll get to the hard part here in a minute but want to put a brief line on security. If you’re younger, you probably wouldn’t think twice about using it. If you’re older, you’ll probably hesitant already to give this app your information. Here’s why you shouldn’t be worried.

You may have never heard of Mint, but I’m guessing you’ve heard of the company that owns it: Intuit. Intuit owns not only Mint but also a few other popular names you’ve heard of like Quickbooks and Turbotax. An estimated 40 million people filed their taxes in 2019 with Turbotax, not to mention the estimated 2 million businesses that use Quickbooks to handle their bookkeeping. If there is one company that can keep your information safe, it’s Intuit.

One of my goals when writing this newsletter has been to never write about things that I won’t or don’t do. I want to be practicing what I preach because, at the end of the day, it’s experience that talks. I personally had downloaded Mint months ago but never set it up (I just use other tools for tracking financials). In preparation for this issue, I went through the setup process to give you some perspective. I also want to give a quick shoutout to Emily Howell, a great friend, and subscriber, for recommending that I write about how to get started with budgeting. If you have things you want to hear about, shoot me an email or comment on this because I really will. Here is a photo of the app icon you’re looking for in the app store, and you can access it HERE.

The beauty of Mint is that it’s extremely intuitive. They have all the prompts you need to guide yourself through the process. What I’d recommend doing is setting aside an hour to set it up fully, though it may take less. I did the process in less than ten minutes, but I also know all my passwords for each of my accounts. Depending on the number of accounts you have, this may take some time. I can’t encourage enough the importance of tracking down old 401ks and bank accounts. This tool, to be effective, needs to see each account you have to get an accurate understanding of your whole financial picture.

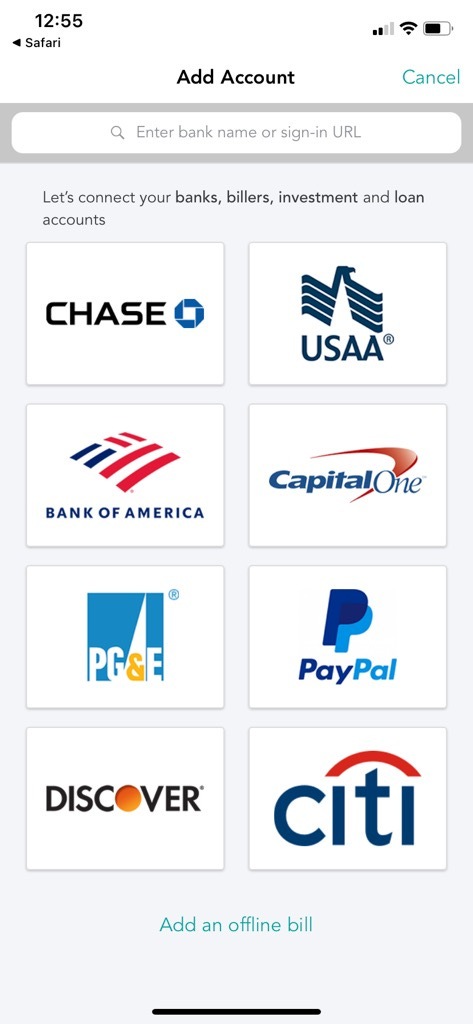

Here’s a picture of the add account screen - if you don’t see yours listed, the search function works great. I didn’t have a single account I could find listed.

Once you’ve got all your accounts added, the hard work is over, I promise. Let’s take a look at some of the cool functionality you can do with this. The home screen it brings you to when you open gives you a running “net worth”. This gives you a quick check-in for where you’re at, listing cash, credit card, and other balances. If you click on any of the balances, it will show you all incoming and outgoing transactions that have occurred on it. The home page also lists recent transactions. I’d recommend linking your credit score - in the upper left corner of the home page you’re able to set that up.

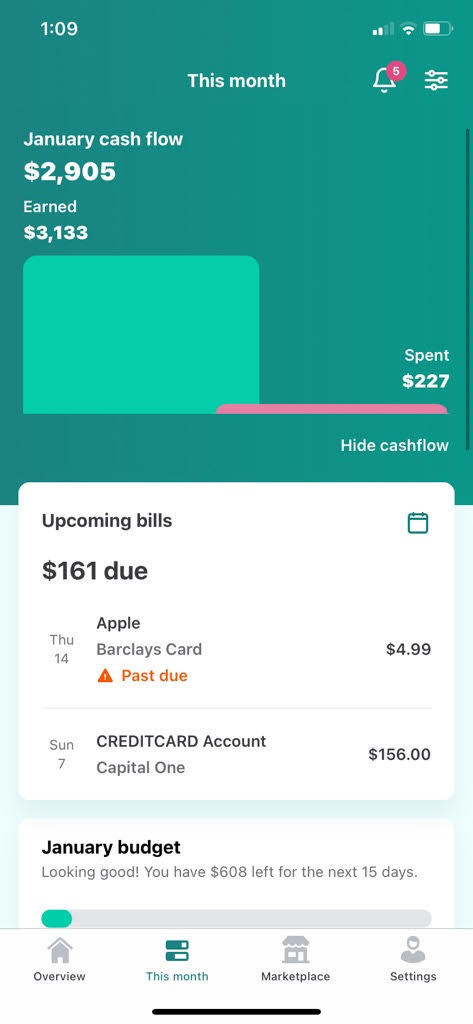

On the “This Month” tab, you’re able to see all incoming and outgoing cash in a visual as well as upcoming bills.

Opening up spending gives you a spending breakdown where you can sort visually to see how much was spent on bills, groceries, phones, gas, and more.

And lastly, you’re able to set up savings goals to track your progress. This is a perfect way to put a name to your goals and set aside money for specific things. It’s also a good place to designate your emergency fund which I wrote more about HERE.

This app has some great tools and does a great job giving a high-level overview of your financials, all in one place. While the app doesn’t do any budgeting for you, it does get all of your information in one place so you have the knowledge to actually begin a budget. If you’re like me and hate having to dig up passwords and would like to just open one tool, this is for you.

One final thought. You may have noticed the format of this newsletter changes from week to week. It’s not because I can’t make up my mind - it’s to try and know you better. I want to write about and include what YOU are interested in. This week you’ll notice below, I’ve included a section on business news with a few of my thoughts. Going forward, if you see something that you like, let me know about it so I can keep doing that! This comment link below is the place for your thoughts.

As always, if you’re looking for more from me, you can check out my personal website, brockbriggs.com. I’ll talk with you next week

~Brock

Big Banks Sending Positive Signals About the Economy: Banks began reporting earnings last week including JP Morgan, Wells Fargo, and Citi. All eyes will turn this week to Bank of America and Goldman Sachs which both report on Tuesday. The banking sector provides insight into not only the economy but the consumers as well. A key indicator to watch will be to see the amount of loan-loss reserves released (money set aside during the pandemic to write off bad loans). The Federal Reserve, in December, also gave the go-ahead for the banks to begin buying back stock which is a positive sign. Read more

My take: The fact that JP Morgan, probably the best run bank in this country at the helm of Jamie Dimon, is beginning to release loan loss reserves is a positive sign to me. While not all have been released, the fact that they have begun means that they see an improvement in the economy and going forward, the American consumer is strengthening.

Increasing Tension with Chinese Technology Company Huawei: President Trump issued another blow to US-based companies supplying materials to Huawei, a restricted entity that has come under fire as a national security threat under his administration. An estimated 400 billion dollars worth of goods were pending approval but have been held up by various agencies. Read more

My take: This action comes in a long line of action against Huawei and is not surprising. Many legacy tech players like Intel and even Boise local Micron supply a lot of goods to Huawei, using workarounds of Trump’s policy to conduct business. The tensions with China have eased generally in light of COVID, but I’m going to be watching for Biden’s stance on relations with China, particularly when it comes to trade.

Tesla Stock Continues To Print Millionaires: Jason Debolt came out on Twitter last week announcing he is retiring at age 39 with 12 million dollars worth of Tesla stock, though he said he still isn’t going to sell any. He isn’t the first person though. There is an entire thread of people on Reddit talking about their Tesla holdings and bragging about their newfound retirement. As long as the price keeps rising, the party will continue. Read more

My take: Tesla stock has defied fundamentals for a long long time, I don’t see any reason why it wouldn’t continue. Many people are looking far beyond just cars, but the potential for the rest of the company. Electric Vehicles, or EVs, are the hot pick on Wall Street right now and anyone that claims to be an EV company believes they can trade like Tesla. While I do believe the stock is overvalued, I strongly believe that Elon Musk will be one of the greatest people of our time, in one way or another.

Apple Joins The Party Kicking Parler Off The App Store: In light of recent goings-on, Parler, the social networking app geared towards conservatives, has been removed from the Apple app store and Google play store for violating content rules and terms of service. Amazon has followed suit by no longer supporting the app on its AWS platform which gives the app its functionality. Read more

My take: The removal of Parler raises a LOT of questions. While I do believe they were right to do so, there are many that will argue that free speech is being impeded. I won’t be surprised to see some big lawsuits over this going forward. This is the first of many steps (like Twitter’s recent action, see next story), towards Big Tech becoming the ultimate authority on what is said. Do we have right to free speech or should it be censored? If it’s censored, who is the moral authority?

Jack Dorsey, CEO Of Twitter And Square, Defends Trump Ban: Last week, we saw the social networking platform Twitter ban President Trump from the platform in the wake of the attacks on the capitol building. Jack came out with a tweet thread justifying the ban, but also calling into question their power to do so. He also called out the growing need for decentralization which is why he is so passionate about Bitcoin. Read more

My take: First off, I’d highly recommend reading Jack’s entire thread HERE. Generally when CEOs of large tech companies make statements, they don’t talk about the fact that they have TOO much power. It’s usually quite the opposite. I appreciate Jack’s transparency on that because I believe that he truly believes it. This ban, like the removal of Parler, raises many questions about who the moral authority is. 60 Minutes did a segment on Section 230, which is a piece of legislation regarding the internet and is ultimately what is in question when it comes to these matters. I’d recommend watching that and reading up on it. While I personally believe there are some things that should be censored, I think it’s more difficult to decide who gets to do the censoring. It becomes a very slippery slope because more likely than not, it will end up in the hands of the government. For those that aren’t familiar with China, the Chinese government completely dictates everything on the internet. I fear that giving the government authority on what we can see is the first step towards that. Only time will tell.

I downloaded Mint about a year ago and attempted to use it. I don’t think I was using it properly or using it to its full potential and fell off very quickly. I may need to try it again.