3 Reasons I'm Joining The Digital Gold Rush

What Is Cryptocurrency And Why It May Be Worth Owning

Welcome to the Scuttlebutt to the 5 new readers this week! If you aren’t subscribed and are looking for actionable finance and business knowledge weekly, join us!

How many times have you heard the word ‘Bitcoin’ or ‘Cryptocurrency’ in the last year? The craze many people thought died in 2017 is back with a vengeance and this time is getting the buy in of many top institutions. Today, I’ll be covering the basics of what cryptocurrency is, why people love and hate it, and why I’ve decided to buy in.

Let’s start from the beginning.

What Is Cryptocurrency

Cryptocurrency is a digital currency or means of exchange. It can be used to buy and sell things just the same as the dollars in your bank account. What makes cryptocurrency different, however, is that no one controls it. That probably sounds scary, but that’s the entire point.

How it works

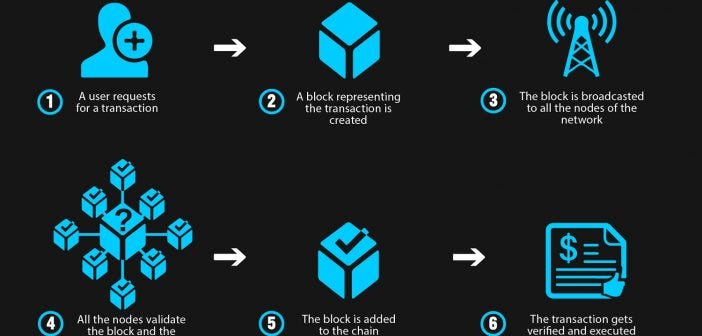

Cryptocurrencies operate on what’s called a blockchain. A blockchain is a decentralized series of digital ‘blocks’ which contain three things: a timestamp of the transaction, data about the transaction, and a cryptographic hash. The cryptographic hash is the element that makes this technology unique. It’s a one way mathematical algorithm that takes information, translates it into a predetermined format, and then links to the next block. Each block builds on the last and is constantly being rechecked and verified by others to ensure all information is correct.

This concept is based on the idea of cryptography which has been around for ages. It was designed to transmit information securely by transforming or encrypting it so it couldn’t be read by people it shouldn’t be. A basic example of this might be creating a key where letters corresponded to numbers which were then used to transmit the information. You’ll only ever read it with the key. You can read more about cryptography here.

What’s most important to understand is the nature of a blockchain creates a secure way to transmit information in a publicly verifiable way.

The Appeal

There are many ideas baked into the functionality of crypto that people love. Describing the process of transactions shows the level of security involved in the process. Having a more secure financial system could lead to less financial fraud and safer transactions. Who doesn’t want that?

While the security appeals to some, others are attracted to its decentralized nature. The blockchain is public information and doesn’t require outside intervention to operate. Governments, particularly foreign ones, don’t like the idea of this because they can’t dictate the terms of exchange. In the US we have the Federal Reserve which controls the amount or supply of money. Crypto works a little different.

The decentralization essentially removes the need for the outside entity. For example, Bitcoin, the most popular cryptocurrency, has a limit of 21 million bitcoin in existence. Limited supply means you can’t add or subtract from the total quantity which provides some positives and negatives that differ depending on where you live.

On the plus side, we’d have zero inflation here in the US. The recent money entering into our financial system with stimulus checks and business bailouts is all new money. Theoretically this drives up inflation, devaluing the dollar. Although the trailing twelve month inflation rate leading up to February was cited as 1.7%, many don’t buy that number.

The Problems

The financial world is extremely divided over the use of cryptocurrency and where it should fall. Should it eventually look to replace all currencies as an exchange, is it an asset class, or something else? To add to the confusion, there isn’t a clear authority on the issue with divided support amongst many top minds in finance. Let’s take a look at some of the issues cited.

Government Intervention May Not Be Bad

Earlier I mentioned why lack of intervention could be a positive to avoid inflation - there’s a caveat to that. Without intervention from our government, many crises like we’ve seen with COVID-19 could potentially cripple us. No wealthy people are rolling out the red carpet to pay for people’s unemployment. The government technically isn’t either (it’s us through taxes) however whats important is the liquidity. We needed liquid dollars to get through a period of economic weakness. We can argue until the cows come home about how that was executed, but I think its a safe assumption to say a large portion of this country would be hurting much worse than they are without the intervention. This wouldn’t be possible on a crypto system.

Does It Pass The Money Test?

What even is money, really? Back before we had dollars we traded sea shells and cigarettes because they had a perceived value. We use the US dollar because we believe that is has value ~ if everyone could print their own dollars from home they wouldn’t have much value would they (hence the inflation argument)?

There are several cited ‘rules’ that constitute if something can be used to exchange goods. The currency should be:

Fungible - All of the same quality

Durable - Be able to be used multiple times

Portable - Divisible into small denominations and able to be transported

Recognizable - Authentic and verifiable

Stable - Hold a consistent store of value over time

The digital nature of crypto answers many of concerns about money, making quality, usability, divisibility, and authentication incredibly easy. The problem comes with the last requirement; stability.

Currently the most popular cryptocurrency, Bitcoin, has been known for its wild price swings. If you had your entire net worth in Bitcoin in 2017, you would have lost half of what you own in a matter of a few short weeks. I don’t think many people are looking to risk that amount of volatility for their life savings. Here is a price chart of the value of Bitcoin over the last 5 years.

Three Reasons I’m Buying In

There are many big arguments for and against the adoption of cryptocurrency. Ultimately, I’m not smart enough to know whether this will or won’t be the future. One framework for investing I adhere to is knowing what you own and why you own it. If you don’t know those things, your conviction is questioned in moments of difficulty which often leads to emotional responses. Those never end well.

After reading extensively on the subject, talking with people I think are smart, and understanding of my personal situation, I’ve decided to buy and hold it for three reasons.

The Digitization of Assets

Every day, more and more things we do are going digital. When I look at how we pay for goods today, the uses for cash and even cards become fewer and fewer. In a time when you can load your card onto your phone to pay for everything, what is the difference between paying with Apple Pay or with your crypto wallet? There really isn’t one; its all just ones and zeros on a screen somewhere.

In my article Traditional to Digital, I mentioned other alternative use cases for blockchain such as ownership verification of digital and physical assets. Blockchain could greatly reduce friction in transferring titles of homes. Having digital, public proof of ownership of something like a house would remove the need for title insurance and streamline the process. Housing is just one area of potential disruption. We are far from either of these, but I see the digital trend moving quickly.

Growing Institutional Support

We are in the early stages of institutional adoption of cryptocurrency. Companies like Square, Tesla, and Microstrategy have purchased large quantities of Bitcoin which is a weighted bet on the future. What is even more profound is large money managers entering the space. Blackrock, an investment management corporation with 8.4 TRILLION dollars under management, recently announced cryptocurrency to be purchased in its funds. Other financial powerhouses like Fidelity are creating ETFs for cryptocurrencies. Companies like Blackrock and Fidelity management so much money that they are really who set the tone of Finance, not only in the US but in the world. If they’re on board, thats a positive signal.

My Personal Risk Profile

The last reason I’ve bought and hold cryptocurrency is my risk profile. I am early in my earning years and have little to lose. Because of the volatility and uncertainty of the future, I started with a small amount of money; only as much money as I was willing to lose. I’m okay with risking a small portion of money for the potential upside mass adoption would bring. I began with 2% of my investable money which has slowly grown to 10% because of the price appreciation.

I’d be lying if I said I didn’t believe there was a chance Bitcoin could go to zero. Maybe a 90% chance even. That said, I don’t want to look back in 10 years and say “That was literally the opportunity of a lifetime and I couldn’t put $100 into it”. Just my personal thoughts.

This isn’t a solicitation to buy or sell Bitcoin or any other cryptocurrency. I’m not a licensed professional nor is this constitute any financial advice. Consult a professional advisor to understand risks involved. And most importantly, do your own due diligence.

Talk next week

~Brock

It’s all about the bitcoin